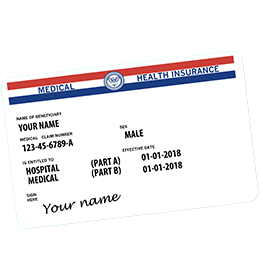

Many people feel surprised to find that Medicare covers only 80% of your Part B expenses. The other 20% can be devastating to you financially if a serious illness arises. Medicare Supplements pay that 20% for you, among other things. Supplemental insurance for seniors with Medicare essentially buy you peace of mind.

About Medicare Supplemental Insurance

Medicare supplements came into being shortly after Medicare was signed into law. Because you are required to pay for some things, like 20% of outpatient expenses, supplemental policies were created to pay those expenses for you. This allows people to have peace of mind about their healthcare. They feel less worry over how much each medical visit will end up costing them.

Some of the primary advantages of a traditional Medicare supplement policy are:

- Freedom to choose your own doctors and hospitals

- You may have little or no out of pocket costs for Medicare-covered services

- Nationwide coverage – you can use it anywhere in the United States

Supplemental insurance for seniors with Medicare is the most predictable back-end coverage that you can buy. You will know exactly what’s covered for every inpatient or outpatient procedure based on which Medigap plan you choose.

Common Questions about Medicare Supplemental Insurance

What is the open enrollment period for Medicare supplemental plans?

When people first active Medicare Part B, they have 6 months to enroll in any Medicare supplement without health questions. The insurance company will approve your application with no pre-existing condition waiting period. We call this the open enrollment period Medicare supplements. It is a one-time window.

Be aware that the Annual Election Period (AEP)that occurs each fall is NOT a time when you can get a Medicare supplemental insurance plan with no health questions asked. The AEP has nothing to do with Medigap plans. Instead, it’s a time when you can change your Medicare Advantage (Medicare Part C plans) and Part D drug plan.

Can you change Medicare supplements anytime?

You can apply to change your Medicare Supplement at any time, but if you are past your open enrollment window, you will have to answer health questions in most states.

The Medicare supplement insurance company will review your health history and medication history. They can accept or decline you.

There are a few states where the rules are different. For example, California, Oregon, Connecticut and Washington have established exceptions to this rule.

What is guaranteed issue for Medicare supplemental insurance?

In certain circumstances, an insurance company must accept you for coverage without asking health questions. For example, if you are on Medicaid and you lose your Medicaid eligibility, you have a short window to apply for Medigap without health questions.

Another example would be for someone coming off employer health coverage that is primary to Medicare. They will have a short window to apply for certain Medigap plans under guaranteed issue rules.

Do you have to have supplemental insurance with Medicare?

No, supplemental is optional. However, with out any supplemental insurance, you would be responsible for expensive hospital deductibles and copays as well as 20% of the cost of ALL outpatients services. This includes things like surgeries and chemotherapy which would be financially devastating without some form of supplemental coverage.

If you find that a Medicare supplement is out of your budget, then you should consider a Medicare Advantage plan, which has lower premiums because you agree to use a network of providers in your local area.

Find the Right Medicare Supplemental Insurance

Sometimes too many choices is NOT a good thing.

Unfortunately, the problem is that Medicare has Parts and Plans. Since they use letters like A & B in both places, people still get confused.

At Senior Insurance Solutions, we can help you understand exactly what each Medicare supplement plan will cover. We’ll even give you some Medicare basics education if you feel unsure of what your Parts A & B already cover. Just give us a call at (414) 241-6143 for a free consultation today.

Free Medicare Help

Let us find the best coverage for you.